8 Easy Facts About Offshore Business Formation Described

Offshore firms operate according to the neighborhood guidelines and also law acts of where they are incorporated. Generally, financiers pick a foreign territory that has more positive policies than their house nations. They set up a firm as well as start a company there in order to enjoy the advantages from such policies.

Nevertheless, if you registered a firm in Hong Kong, its revenue would only be strained from 8. 25% type 16. 5%. In addition to that, the income that is made beyond Hong Kong can be entirely exempted from regional tax obligation. Corporate titans do this all the time. Apple, Samsung, Google, Berkshire Hathaway, they all have actually developed offshore companies as their subsidiaries in many countries throughout the globe.

The smart Trick of Offshore Business Formation That Nobody is Discussing

Various other regular advantages consist of much better privacy, property security, ease of consolidation, as well as affordable maintenance. Some nations enforce extremely high tax obligation rates on company revenue. Instance, The prices are 37. 5% in Puerto Rico, 30% in Germany, and 25% in France That's why hundreds of entrepreneurs around have actually made a decision to go offshore.

Tax obligation optimization does not necessarily indicate to evade taxes. When looking for tax remedies, you should conform with both the legislations in the bundled territory and your home nation.

Things about Offshore Business Formation

They are starting to impose taxes and policies on certain kinds of earnings as well as organization tasks. As well as some areas have a really bad track record in the service world.

In certain, banks in Singapore or Hong Kong are really concerned about opening up an account for business in tax places. They would certainly likewise be concerned to do company with your business if it is integrated in such territories.

Rumored Buzz on Offshore Business Formation

That's why comprehensive preparation and also research study is a have to (or at least the ideal assessment from the actual specialists). Instance Here is an instance for overseas preparation: You open a firm in the British Virgin Islands (BVI) to offer solutions overseas. You additionally develop your firm's management in another country to make it not a BVI-resident for tax obligation purposes.

As well as because BVI has a reasonable track record, you can open up a company financial institution account in Singapore. This will allow your company to get money from consumers easily. look at here now If required, you after that require to develop your tax obligation residency in an additional country where you can obtain your business money without being tired.

Offshore Business Formation for Beginners

These nations usually have a network of worldwide tax treaties, which can bring you tax obligation decrease and even exemption. If you accept paying a small amount of tax in return for regard and also stability, low-tax territories can be the right selection.

This means, your possessions are secured against the judgment made by international courts. Just the court of the consolidation jurisdiction can position a judgment on the assets. If you formed a trust in Belize, the trust fund's residential property would be shielded from any insurance claim according to the regulation of an additional jurisdiction.

Top Guidelines Of Offshore Business Formation

Some other typical overseas facilities that provide monetary personal privacy are the BVI, Seychelles, Cayman Islands, and also Nevis. The offshore incorporation procedure is rather straightforward and also rapid.

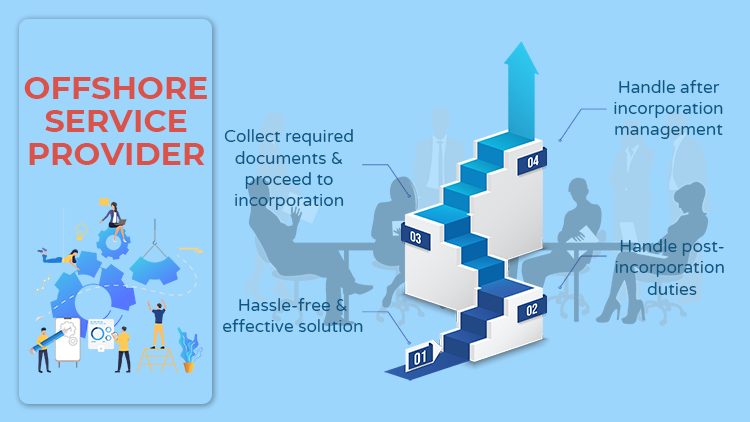

The consolidation needs are usually very minimal. The very best thing is that numerous company available can help you with the enrollment. All you need to do is discover a trustworthy company, pay for service, and supply essential records. They will certainly go on and register the firm in your place.

About Offshore Business Formation

: Situated in the western Caribbean Sea, this is a very usual selection for many foreign investors who are looking for tax-free benefits.: BVI and Cayman Islands share numerous useful site typical functions - offshore business formation. However a plus is that the incorporation expense in the BVI has a tendency to be a lot more budget friendly than that in the Cayman Islands.

There are loads of different kinds of organization entities. When picking your kind of entity, you must take into consideration the adhering to elements: The entity legal standing visit site The responsibility of the entity The tax and various other advantages of the entity Suggestion, The recommendations is to go for the kind of company that has a different legal status.

The 9-Minute Rule for Offshore Business Formation

A separate legal entity guarantees you a high level of safety and security. Each jurisdiction has a various set of requirements and unification procedure.

The Buzz on Offshore Business Formation

The reason is that foreigners do not have specific tools and also accounts to register by themselves. Even when it is elective, you are still recommended to make use of an unification service. Certainly, you can do it on your own but that would certainly cost lots of effort and time. Why not leave the tough job to the professionals? They have a lot more experience and understand specifically what needs to be done.